45% of all insurance industry CIOs identify outdated legacy systems as a key blocker to digital transformation.

Celent 2018

Intelligent back-office processes for insurance companies

Digitization is an immense challenge for insurance companies. Customers are demanding ever faster services. The competition is becoming increasingly digital.

However, inflexible legacy systems make it difficult to respond appropriately and adapt to new market conditions.

In this environment, intelligent process automation such as Robotic Process Automation (RPA / IPA) with PIPEFORCE opens up new opportunities. Process runtimes can be reduced by more than 80%.

This allows you to offer your customers significantly faster service and reduce the workload of your employees.

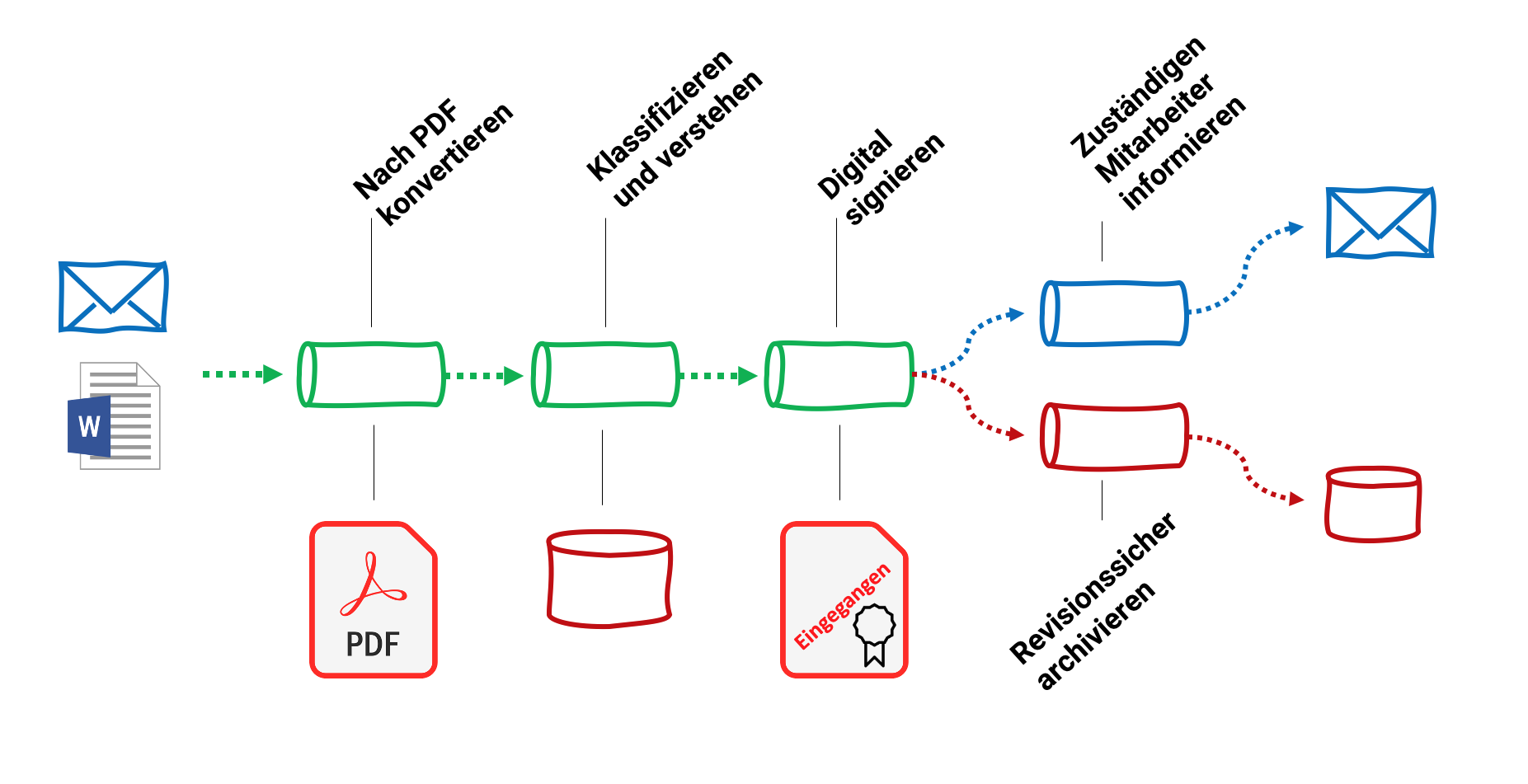

This is how it works

Where cross-system processes require lengthy interface developments in classic automation, our software bots simply reproduce the work steps, reconciliations, entries and data transfers previously performed manually by the clerks.

This allows a bot to efficiently automate complex, cross-system work steps and ({mark>permanently adapt to new requirements.

In this example, incoming customer correspondence is automatically classified, important attributes are extracted and saved, then the document is archived in an audit-proof manner and forwarded to the responsible employee. In some situations, forwarding to an employee can even be dispensed with, or an automatic query can be made with the customer. All steps can also be combined with each other like building blocks and adapted at any time without programming knowledge.

You want to know in more detail how this works?

Use Cases

You need more information?

Talk to a product expert and learn how to get started with ease.